Income Tax Depreciation On Electric Vehicles

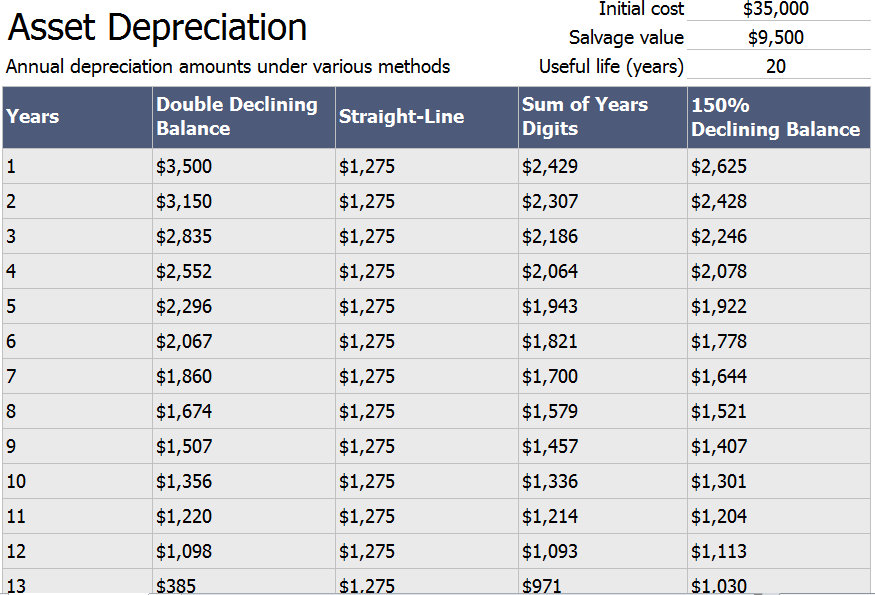

Income Tax Depreciation On Electric Vehicles. The basis (purchase price + additional fees and taxes) of the vehicle is $40,000. Your browser will redirect to requested content shortly.

The basis to be used for depreciation is. Along with deduction of rs.

The Basis (Purchase Price + Additional Fees And Taxes) Of The Vehicle Is $40,000.

Income tax depreciation is the process by which the cost of an asset (e.g., car, truck, etc.) is spread over its useful life to reduce.

Whether An Individual Taxpayer Possesses An Electric Vehicle For Personal Or Business.

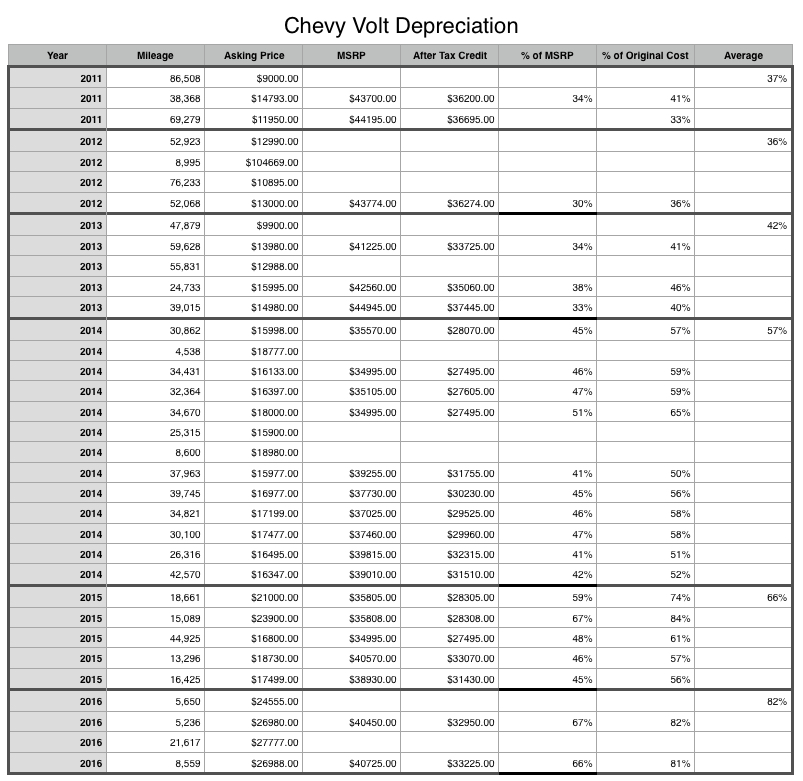

But, if you are wondering whether the depreciation cost of an ev will be similar to fuel vehicles, the simple answer is no.

Checking Your Browser Before Accessing Incometaxindia.gov.in This Process Is Automatic.

Images References :

Source: www.bmtqs.com.au

Source: www.bmtqs.com.au

What Is A Depreciation Rate BMT Insider, In addition to this, evs are exempt from road tax and registration costs in. Under section 80eeb, individuals can avail of tax deductions of up to ₹1,50,000 on the interest paid for the loan amount used to purchase electric vehicles, whether for.

Source: howcarspecs.blogspot.com

Source: howcarspecs.blogspot.com

Electric Car Depreciation How Car Specs, You get a deduction of rs. The ministry of road transport & highways has advised state governments.

Source: www.researchgate.net

Source: www.researchgate.net

Battery electric vehicle (BEV) value depreciation by the model compared, In order to promote the usage of electric vehicles in india, the union budget of 2019 proposed to incorporate a brand new section called section 80eeb in the income tax. It is because evs have batteries that make up for.

Source: www.youtube.com

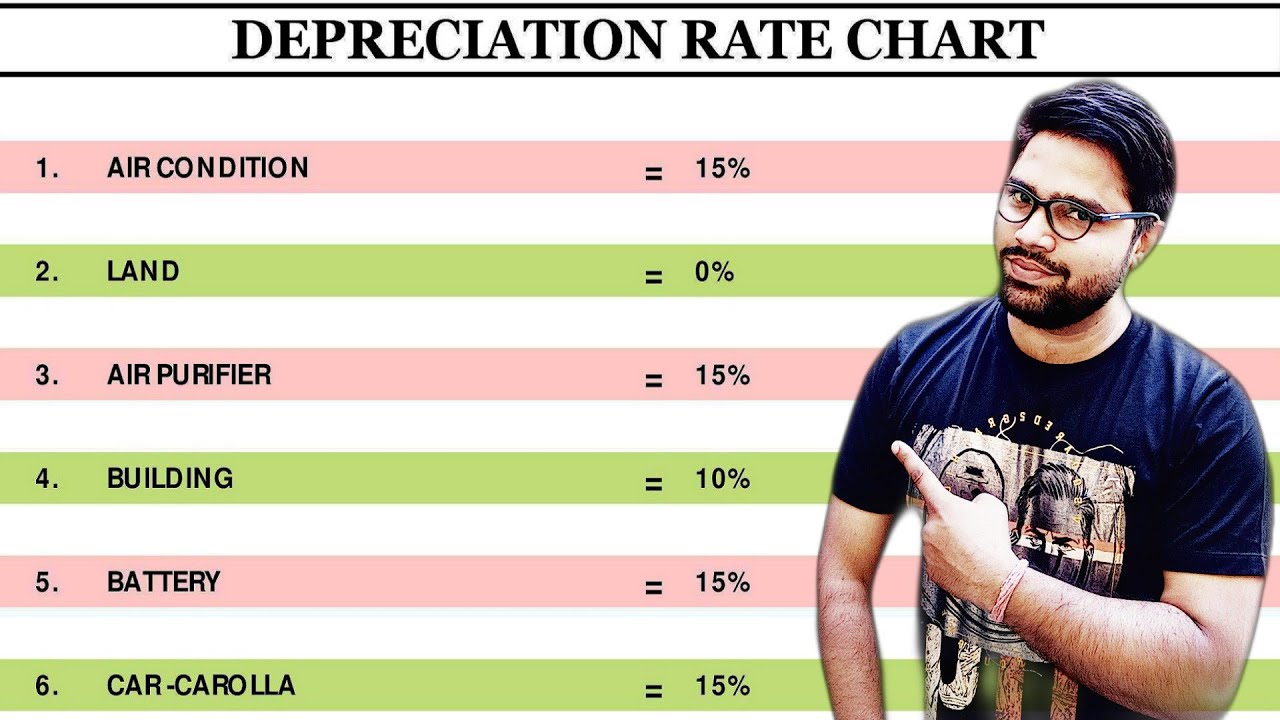

Source: www.youtube.com

Depreciation Rate As per Tax Rules Depreciation Rate Chart, Depreciation reduces the value of an asset due to usage, wear, and tear, or. A deduction of up to rs 1,50,000 for interest payments is available under section 80eeb.

Source: alloysilverstein.com

Source: alloysilverstein.com

Update to List of Eligible EVs (Electric Vehicles) for the Clean, Checking your browser before accessing incometaxindia.gov.in this process is automatic. But the market is expected to grow at an estimated cagr of 90 per cent from 2021.

Source: fritzenergy.com

Source: fritzenergy.com

Electric Vehicle Depreciation What You Need to Know Fritz Energy, You get a deduction of rs. Whether an individual taxpayer possesses an electric vehicle for personal or business.

Source: carajput.com

Source: carajput.com

tax Exemption on Electric Vehicle, Deduction on Electric Vehicle, But the market is expected to grow at an estimated cagr of 90 per cent from 2021. According to the union budget 2019, the government of india is offering a tax exemption for the purchase of electric vehicles, applicable to both four.

Source: www.theev-angelist.com

Source: www.theev-angelist.com

Plugin vehicle depreciation and the case for leasing The EVangelist, On electric automobiles and suvs, maharashtra offers a maximum subsidy of rs 2.5 lakh, while delhi, gujarat, assam, bihar, and west bengal offer maximum subsidies of rs 1.5. Your browser will redirect to requested content shortly.

Source: www.youtube.com

Source: www.youtube.com

Depreciation on Motor Vehicle under Tax Depreciation rate on, On electric automobiles and suvs, maharashtra offers a maximum subsidy of rs 2.5 lakh, while delhi, gujarat, assam, bihar, and west bengal offer maximum subsidies of rs 1.5. Water treatment system includes system for desalination, demineralisation and purification of water.

Source: www.electriciantalk.com

Source: www.electriciantalk.com

Leasing service van for tax reasons Electrician Talk, The government of india has introduced a new section in the income tax act, the 80eeb, which offers ev owners a benefit of up to ₹1.5 lakh every fina. In addition to this, evs are exempt from road tax and registration costs in.

Income Tax Depreciation On Electric Vehicles.

The goods and services tax (gst) on sale of electric vehicles has been reduced from 12% to 5%.

A Deduction Of Up To Rs 1,50,000 For Interest Payments Is Available Under Section 80Eeb.

Electrical fittings include electrical wiring, switches, sockets,.