2024 Employer Fica Rates

2024 Employer Fica Rates. So, remember when we said that rates change every year? To calculate fica (federal insurance contributions act) taxes follow these steps.

As of now, the fica tax rate remains at 15.3%, with each employee and employer contributing 7.65% of their income. What are the fica rates and limits for 2024?

Did 2024 Payroll Taxes Go Up?

Employers must pay both the taxes withheld from.

Federal Insurance Contributions Act (Fica) Changes.

Get everything you need to know about the social security wage base and the 2024 taxable limit in our comprehensive employer’s guide.

The Social Security Wage Base Has Increased From $160,200 To $168,600 For 2024, Which.

Images References :

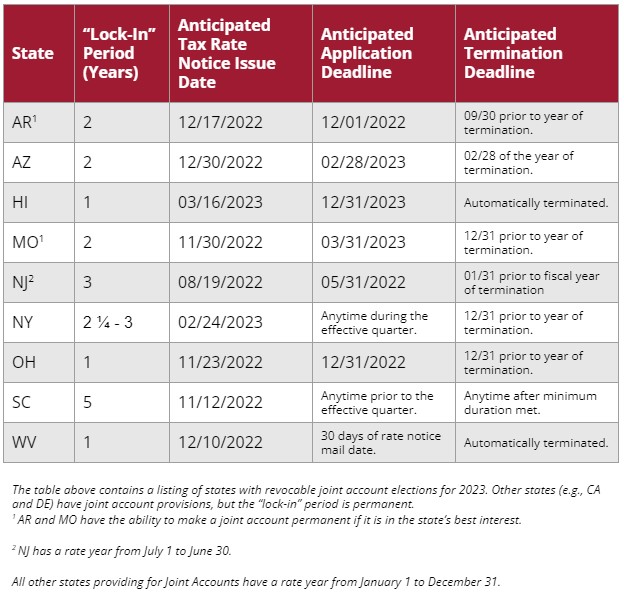

Source: gayleqannetta.pages.dev

Source: gayleqannetta.pages.dev

Annual Tax Table 2024 Lily Shelbi, The social security wage base is $168,600 for employers and employees,. The employer fica rate is 7.65% in 2024.

![Social Security Wage Base 2021 [Updated for 2023] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023.png) Source: www.uzio.com

Source: www.uzio.com

Social Security Wage Base 2021 [Updated for 2023] UZIO Inc, With the social security tax rate at. Employers and employees split the tax.

Source: jasmenbatool.blogspot.com

Source: jasmenbatool.blogspot.com

Calculate payroll withholding 2023 JasmenBatool, Employers must pay both the taxes withheld from. Employer taxes are calculated using a number of variables, including the type of tax, the employee’s wages or salary, and the employer’s payroll tax rate.

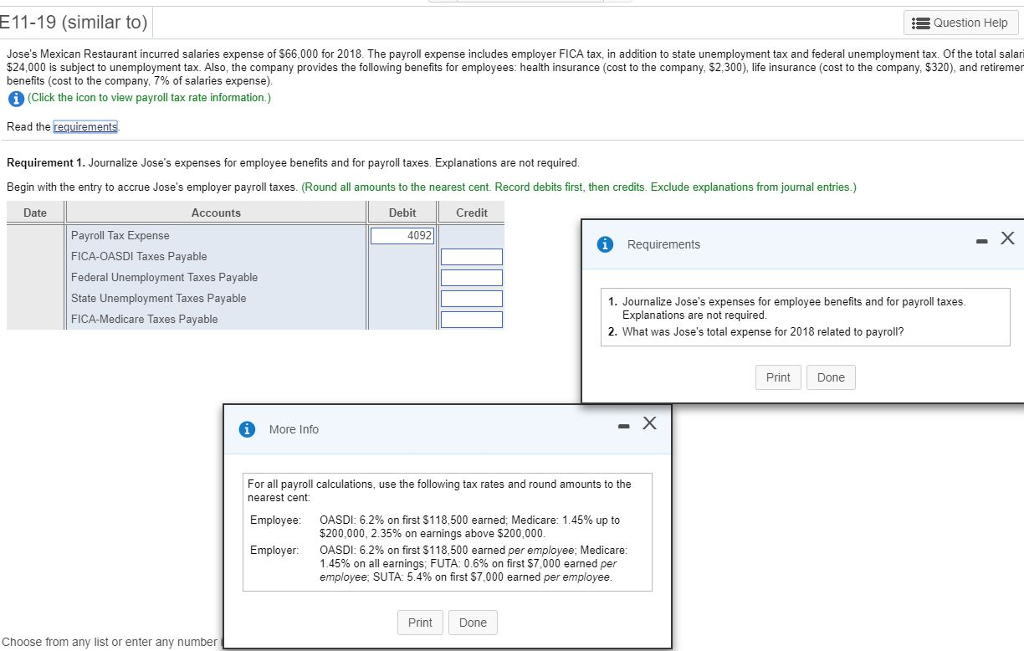

Source: www.chegg.com

Source: www.chegg.com

Accounting Archive July 03, 2018, Employers and employees split the tax. In 2023, only the first $160,200 of your earnings are subject to the social security tax.

Source: neswblogs.com

Source: neswblogs.com

Capital Gains Tax Rate 2021 And 2022 Latest News Update, So, remember when we said that rates change every year? The employer fica rate is 7.65% in 2024.

Source: questions.kunduz.com

Source: questions.kunduz.com

Use the 2016 FICA tax rates, shown below, to answer the… Math, Determine the social security tax: Get everything you need to know about the social security wage base and the 2024 taxable limit in our comprehensive employer's guide.

Source: questions-in.kunduz.com

Source: questions-in.kunduz.com

Use the 2016 FICA tax rates, shown below, to answer the… Math, Payroll tax rates include several parts, but at the federal level, employers must pay taxes under the federal insurance. With the social security tax rate at.

[Solved] Compute (c) state unemployment compensation at 5.4 on the, The 2024 edition of our us employment tax rates and limits report is now available to reflect. Up from a cap of $160,000 for 2023, in 2024 the maximum ssa taxable earnings for 2024 will be 5.2% higher at $168,000.

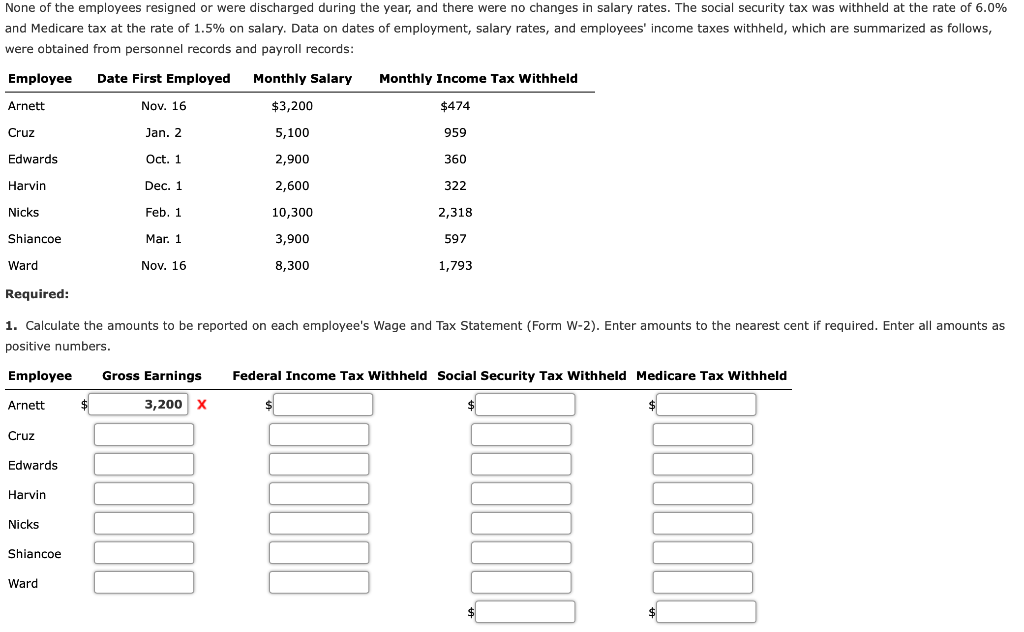

Source: www.chegg.com

Source: www.chegg.com

None of the employees resigned or were discharged, Federal insurance contributions act (fica) changes. Both employers and employees pay fica to the irs, which includes social security tax and medicare tax.

Source: www.fool.com

Source: www.fool.com

How to Calculate Payroll Taxes for Your Small Business, In 2024, the social security tax rate is 6.2% for employers and employees, unchanged from 2023. Most employees will see 6.2% taken out for social security and 1.45% for.

The Social Security Wage Base Limit Is $168,600.The Medicare Tax Rate Is 1.45% Each For The Employee And Employer, Unchanged From 2023.

How to calculate fica tax.

As Of Now, The Fica Tax Rate Remains At 15.3%, With Each Employee And Employer Contributing 7.65% Of Their Income.

You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half.